How do students really feel about their banks? Do buy now, pay later services appeal to them? And do many still use cash? The Student Banking Survey 2023 reveals all this and more.

Credit: fratello – Shutterstock

Now in its ninth year, the Student Banking Survey provides a very interesting insight into how students approach banking and money management.

This year, we heard from just over 800 undergraduate students about their views and experiences of banking and borrowing money.

A particularly worrying finding from this survey is that a growing proportion of polled students report relying on overdrafts and credit to fund their spending. In the context of the cost of living crisis, this highlights the immense financial pressures that students have faced – and are continuing to face – this academic year.

What's in this report?

- Key findings

- How do students choose a bank?

- Do students consider switching banks?

- What is the most popular bank among students?

- Student satisfaction with their banks

- Student borrowing habits

- What do students think about BNPL services?

- How many students have Lifetime ISAs (LISAs)?

- Use of cash among students

Key findings from the Student Banking Survey 2023

Here are some of the key findings from the Student Banking Survey 2023:

- Santander is the most popular student bank.

- 26% of students in the survey are looking to switch banks.

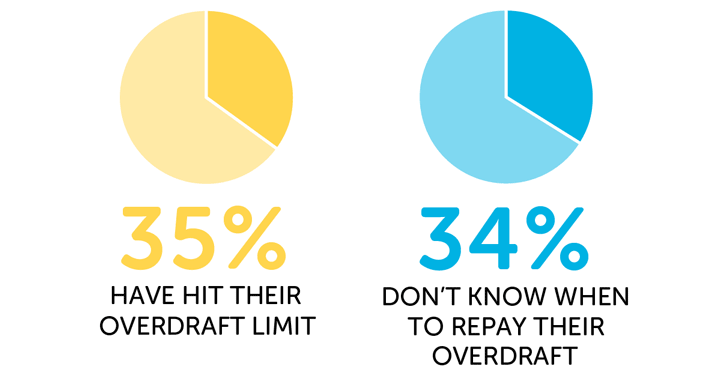

- Among students that have overdrafts, 35% have hit their limit at some point.

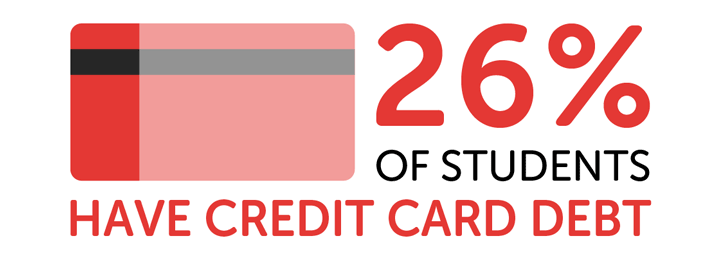

- Over a quarter have credit card debt.

- The proportion of students who use BNPL sites has increased significantly since the 2022 survey, up from 22% to 43%.

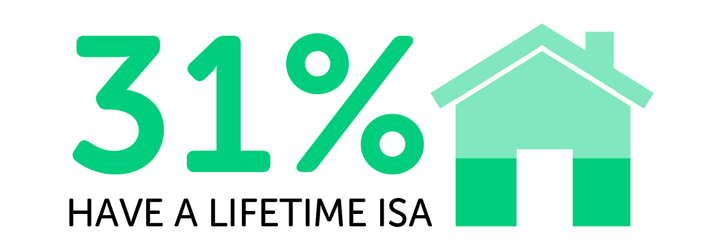

- 31% have a LISA – up from just 18% last year.

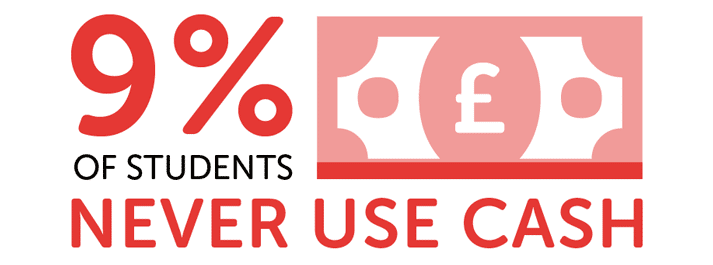

- Nearly one in 10 students never use cash.

How do students choose a bank?

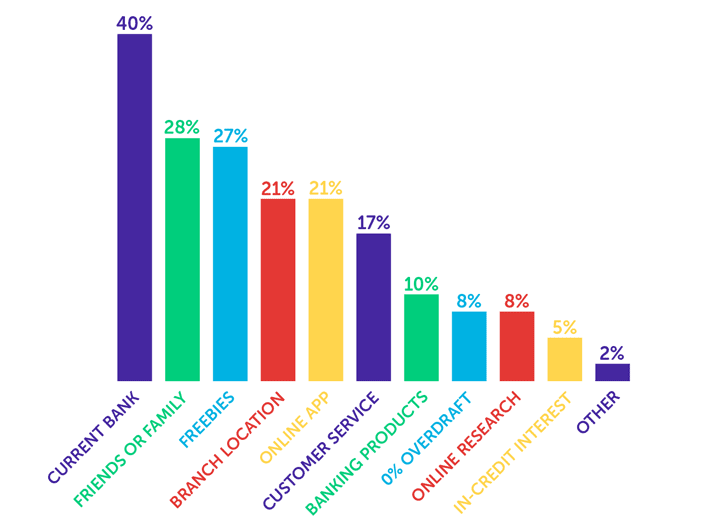

We asked students in the survey how they chose their bank account. Here's what they said:

Two in five students in the survey said they chose the bank they were already with.

Following this, the next most common reasons were if their friends or family were with the bank (28%) and if there were good freebies/discounts on offer (27%).

Where do students do bank account research?

| Type of research | What proportion used this method? |

|---|---|

| Online | 71% |

| Parents | 39% |

| Friends | 25% |

| School | 11% |

| Bank | 16% |

| University or SU | 5% |

| Other | 2% |

71% of students in the survey said they used online resources to find out about bank accounts, making it by far the most common way to do banking research.

And, similar to the above finding that 28% chose the same bank as their family and friends, advice from loved ones is also a big part of students' research into different banks. Just under two in five turned to their parents for banking info, while a quarter asked their friends.

Here's what students in the survey said about choosing a bank account:

- The perks were a bit rubbish last year. I got a free Railcard with mine but had already [bought one] so it was useless.

- I like the discounts given when you join.

- Student bank accounts should be easier to open after first year and student credit cards should be more common.

- [...] I've heard from everyone that Santander was the best, so it wasn't really something I thought about too much.

- Better freebies would be great but it's good as it is.

- [It] would be good to have more freebies and student-tailored money advice.

- I think more information needs to be available about [the] ethics of banks.

- Make the apps more user friendly.

Do students consider switching banks?

While the majority of students in the survey are happy to remain with their current bank, just over a quarter said they are thinking about switching. This is noticeably up from the Student Banking Survey 2022, when 12% had said the same.

There are potential benefits to switching bank accounts. In fact, some banks offer as much as £200 as an incentive for people to switch to them.

However, not everyone is aware of the benefits of switching, and some expect it to be difficult to arrange.

Here are some reasons students gave for why they are looking to switch banks:

- To get the money benefit of changing account.

- I want to switch to a bank with higher interest rates.

- Because I am not a huge fan of the app design.

- I can get a better interest rate and overdraft somewhere else.

- Only if there is a really good cashback offer for switching.

And here are some reasons others are not looking to switch:

- I'm nervous about switching. I don't think I trust myself to make a good decision.

- It is easier to stay with my current bank than to switch.

- Although other banks offer better deals, it is [too] much of an annoyance to change banks.

- I don't think there would be a better offer for myself.

- Because my bank account is very good for online banking.

What is the most popular bank among students?

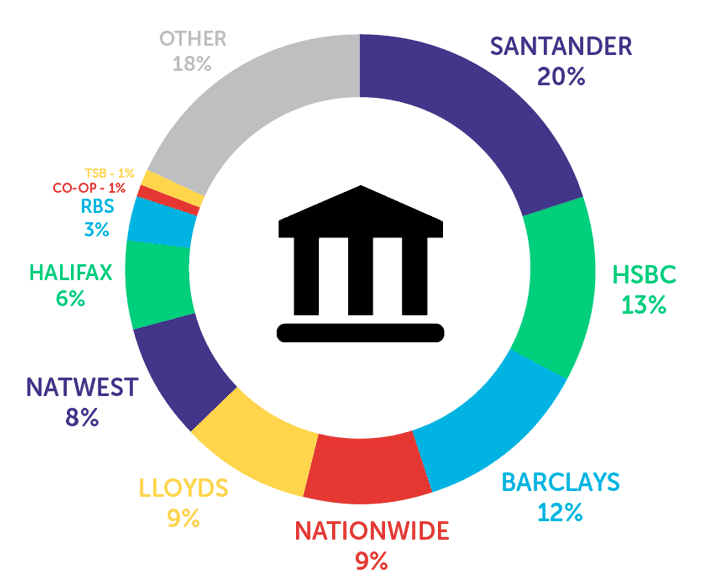

Compared to last year's survey, there has been very little change in terms of the most popular student bank accounts.

Santander continues to be the most commonly used bank, followed by HSBC, Barclays and Nationwide.

Interestingly, 72% of students in this survey mentioned having a secondary bank account. In the 2022 survey, this had been 66%.

When we asked students where (if anywhere) they held a secondary bank account, these were the 10 most popular options:

- Monzo – 9%

- HSBC – 8%

- Barclays – 6%

- Nationwide – 5%

- Santander – 5%

- Halifax – 5%

- Lloyds – 5%

- Chase – 5%

- Revolut – 5%

- NatWest – 4%.

Student satisfaction scores

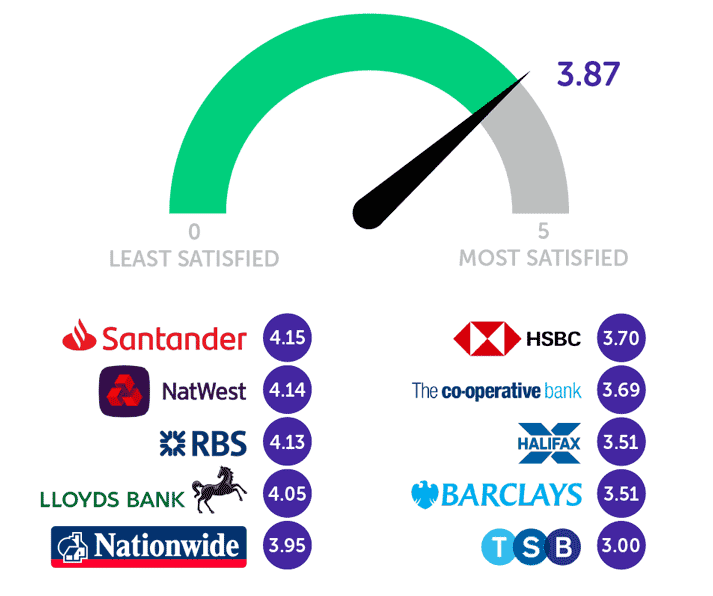

On average, students rated their bank 3.87 out of 5, suggesting a general satisfaction with the accounts.

In fact, a huge 92% of students in the survey said they would recommend their bank to a friend.

But which banks had the highest ratings?

Santander is not only the most commonly used student bank account among those in the survey, but it's also rated very highly at 4.15 out of 5.

This is closely followed by NatWest (4.14 out of 5) and RBS (4.13 out of 5).

Unfortunately, TSB was ranked the lowest among the banks that offer a student account, receiving an average score of 3 out of 5.

It's worth noting that some app-based banks received impressive satisfaction scores in the survey, despite not offering student-specific accounts. A few examples are Chase (4.61 out of 5), Starling (4.55 out of 5) and Revolut (4.44 out of 5).

Student borrowing habits

In this survey, we've seen concerning increases in the proportions of students that use overdrafts, have credit card debt and shop with buy now, pay later services.

How overdrawn are students?

| Size of overdraft | Students overdrawn by this amount |

|---|---|

| Not overdrawn | 64% |

| £99 or less | 10% |

| £100 – £499 | 10% |

| £500 – £999 | 7% |

| £1,000 – £1,999 | 6% |

| £2,000 and over | 1% |

| Rather not say | 2% |

Over the last couple of years, we've seen a gradual trend towards more students using their overdrafts.

If we look at the 2021 survey, 79% said they weren't overdrawn. In 2022, this dropped slightly to 74%. And this year, it's dropped further to 64%.

In itself, it isn't necessarily a major cause for concern that more students are using their overdrafts. A perk of student bank accounts is the fee- and interest-free overdraft which lets people access extra funds when needed, such as between Maintenance Loan instalments.

However, what we're seeing in this year's survey is that students are not only more likely to use their overdraft, but also to hit their maximum limit – and this is concerning. In fact, among those that had an overdraft, 35% said they had hit their limit at some point. In last year's survey, 27% had said the same.

This suggests that many students are not simply 'dipping into' their overdraft, but rather relying heavily on those extra funds. And this is something that could cause real challenges when it comes to paying back the borrowed money in future.

We also asked students if they knew when to repay their overdraft. Among those that had an overdraft, 34% said they weren't sure. While this is still much higher than we'd hope to see, it is down from 46% last year.

It's important that students fully understand the terms of their account, including how long they will have to repay their overdraft with a graduate bank account.

Here's what students in the survey said about their views and experiences with overdrafts:

- It's good that we get [an] interest-free overdraft just in case, I just think we should get the option of how much overdraft as it does scare me that I'm able to spend £1,000 of money I don't have. I'd rather have a smaller amount that's there for emergencies.

- Overdraft limits are dangerously high and as a student if I had one it would be difficult to get out of it.

- No one tells you how much [the] overdraft will save [your] life and it shouldn't be stigmatised against because, even at the highest loan, I struggle to keep up.

- It is concerning how many students flippantly use their overdraft as if it is free money.

Do students have credit card debt?

Another concerning finding from this survey is that 26% said they had credit card debt. This is a big increase from last year, when 14% had said the same.

While credit cards can be helpful in some situations when used carefully, they do come with risks – as do buy now, pay later (BNPL) services, which have also seen an increase in usage among surveyed students.

How many students use BNPL services?

In this year's banking survey, over two in five said they shopped with BNPL payment services. Broken down, this includes 9% that used them often and 34% that used them sometimes.

This is almost double the proportions from last year, when 5% had said they often used them often and 17% said they sometimes did.

When we asked if they had ever made a late BNPL payment, 38% said they had.

We have heard some very mixed views about BNPL. Here are some examples of comments from students in the survey when we asked what they thought of these types of payment services:

- They are good but very addictive.

- [It] scares me to spend money before I have it.

- Bad when aimed at students.

- [I] don't like them as I don't want to get behind on payments.

- They are good if you are financially stable but not great for students and young people.

- Helpful but should be used lightly and not taken advantage of.

- They're okay. Convenient and good if you can use them responsibly.

- Slippery slope but too tempting.

- They ruin your credit rating and I would be drastically in debt if I started using them.

- Terrible – it encourages people to spend money that they don't actually have.

- I think they take advantage of people and should not be allowed. They make it far too easy to get into debt and they are everywhere.

- Helpful for some people but people should be careful and save money before spending.

How many students have Lifetime ISAs (LISAs)?

One positive finding from this survey is that we've seen an increase in the proportion of surveyed students saying they have a Lifetime ISA (LISA). It's up from 18% who said they had one last year, to 31% saying they do this year.

With the annual 25% bonus from the government (up to £1,000 per year), the accounts can hugely help people save up for their first house.

How often do students use cash?

Just under one in 10 students in the survey said they never use cash. Last year, 10% said the same, so there has not been much change in this area of student banking.

The majority still use cash at least some of the time, but a steady proportion are remaining cashless.

About the Student Banking Survey 2023

- Source: Student Banking Survey 2023 / www.savethestudent.org.

- The statistics in this report are based on 801 responses.

- Students were polled between 24th March – 18th April 2023.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

source https://www.savethestudent.org/money/surveys/student-banking-2023.html