Rent struggles, shoddy housing and homelessness are just some of the many issues explored in the National Student Accommodation Survey 2024.

Credit: Monkey Business Images – Shutterstock (background)

The eighth annual National Student Accommodation Survey asked over 1,000 students about their experiences with managing the costs of housing at university.

This survey's results reflect a key concern of ours and others within the higher education sector, that recent below-inflation increases to Maintenance Loans are getting baked into the system, especially for students from England. As a result, the challenges from the cost of living crisis are essentially getting extended for the foreseeable future for many students.

Instead of improving the situation for the next academic year, the government announced in January 2024 that Maintenance Loans in England will increase by just 2.5% in 2024/25. This is based on forecasted inflation, as the 2.8% increase in 2023/24 had been. However, these minimal increases are simply maintaining, if not widening, the real-terms gap created by previous forecasting errors.

We can see the impact of these insufficient funding increases, with some students telling us their loan doesn't even cover rent, let alone any additional living costs beyond that.

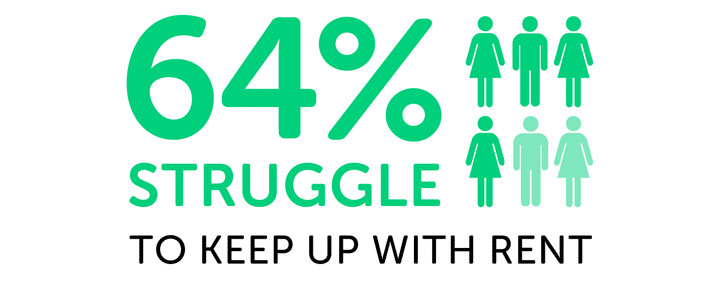

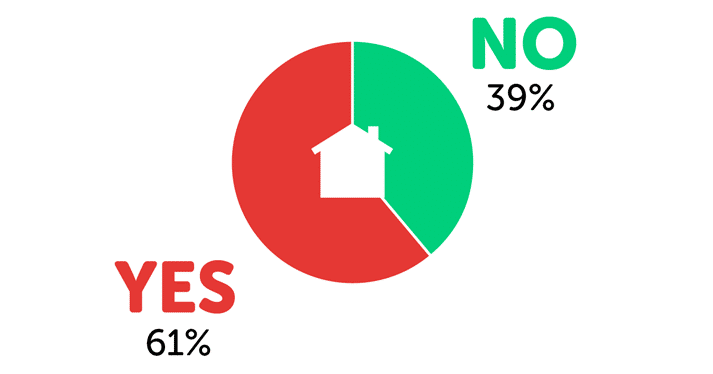

Nearly two-thirds of surveyed students who pay rent said they struggle with it at least some of the time. This is far too many, and it concerns us that this is becoming the new normal.

We ask the government to urgently recognise how much more needs to be done to ensure students can, at the very least, afford the cost of accommodation.

What's in this report?

Key findings

Here's an overview of the key findings from the National Student Accommodation Survey 2024:

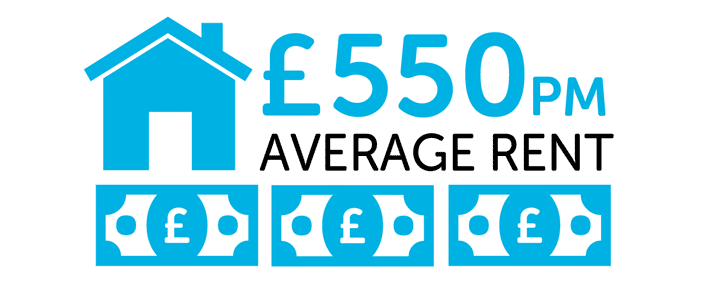

- £550 is the average monthly rent among surveyed students. London has the highest monthly average of £778.

- Among those who pay rent, 64% said they struggle with the cost at least some of the time. This includes 20% who described it as a constant struggle.

- Two in five have thought about dropping out due to the cost of rent.

- Over a third have had issues with damp.

- 7% said they have experienced homelessness.

- 14% don't think they will ever be able to buy a house.

Expert comment

Save the Student's Communications Director, Tom Allingham, says:

The results of this year's survey are deeply concerning, and highlight how life in a cost of living crisis is at risk of becoming the new normal for students.

Many findings are as bad as – if not worse than – in 2023, highlighting how the intensified difficulties students have faced in recent years have not eased, but instead become entrenched.

This prolonging of the cost of living crisis is largely thanks to below-inflation increases to the Maintenance Loan in England. And, with just a 2.5% increase announced for 2024/25, these real-terms cuts are becoming baked into the system.

Action is needed to address the myriad of issues with the availability, quality and affordability of accommodation – and this must be coupled with a sizeable increase to the loan.

We're calling on the government to increase Maintenance Loans by well above 2.5% next year, to close the inflationary gap and ensure students can actually afford to cover everyday expenses like rent.

Where do students live during term time?

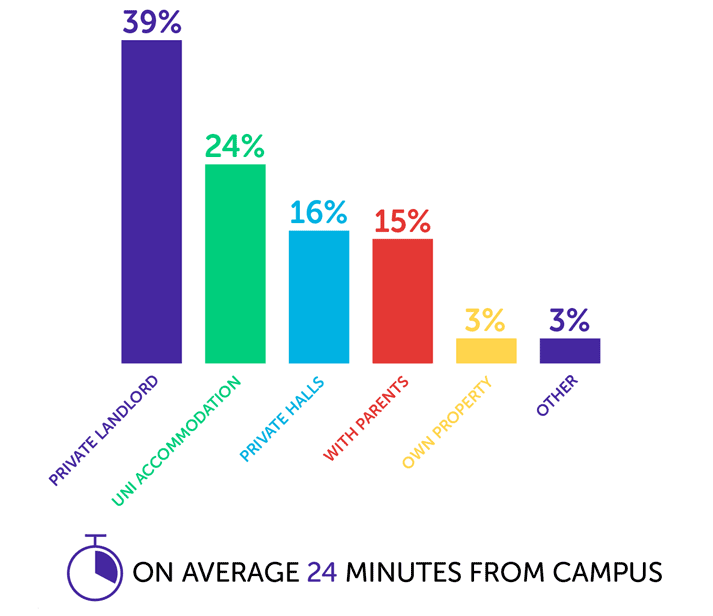

Among students in the survey, the most common accommodation type was rented houses or flats, with 39% saying they had private landlords.

A further 24% lived in university halls, and the proportions living in private halls and with parents were close to equal at 16% and 15% respectively.

On average, students were living 24 minutes from campus, which is the same as in last year's survey.

When do students look for accommodation?

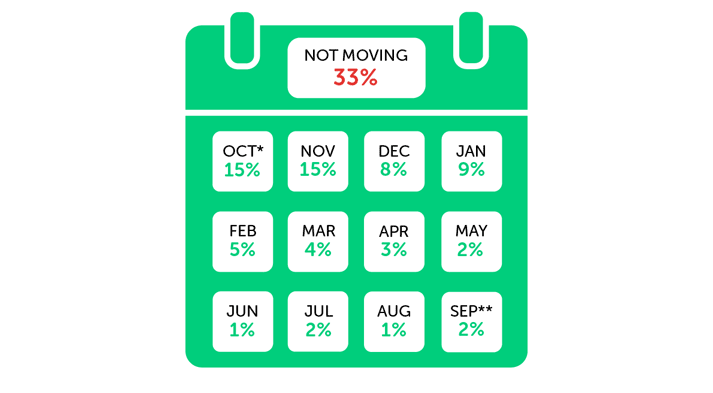

Here's an overview of when students start looking for accommodation:

* Students who answered 'before November'.

** Students who answered 'after August'.

A noticeable difference compared to last year is that surveyed students are generally looking for accommodation slightly earlier.

In 2024, 30% said they started looking in or before November. This is higher than in the 2023 survey when it had been 25%.

The student housing shortage crisis

Despite a higher proportion of surveyed students looking for accommodation in November or earlier compared to last year, the percentage worried about the student housing shortage is very similar. It is up by just one percentage point from 50% last year to 51% this year.

Here's what students told us about how the crisis is impacting them:

- Housing is limited in York and as such it is a struggle to find housing. Most people need to sign for a house in December to make sure they have one for the next year and because housing is in a short supply, landlords seem to be putting the rent up much faster than what is in line with other areas/the economy because students have no other choice. (Private landlord)

- I want to study my master's in London but because of the overall housing shortage alongside the large Student Loans I am [considering] studying abroad. (With parents/guardians)

- The housing shortage I think is pushing up house prices – because of the limited housing, landlords are able to increase prices because the students have no choice but to pay them. (Private landlord)

- My university has a severe lack of accommodation places for the number of students. As I got my place through Clearing it took weeks to find a private halls residence after hours of refreshing the page, and now I'm locked into a really expensive contract that I am struggling to afford and isn't worth the cost. Since I got my accommodation later than others, they also charged me an extra £40 per week (£230 to £270) and didn't offer anything other than a 51 week contract which I don't need. (Private halls)

- I am afraid due to the shortage of houses and the high demand I won't be able to find anywhere to live. (With parents/guardians)

- My flatmate and I really struggled when looking for houses – all of the properties that fit our requirements and looked to be in good condition/were good value were always immediately booked fully for viewings within minutes of being put online. It was very competitive and stressful just to get a viewing, we had to be watching property sites 24/7 and calling as soon as anything suitable came up. There were a few properties we viewed that were okay, but just not reasonably worth the amount they were charging. All of the decent properties in York get snatched up immediately and all of the poor ones are still charging a high price due to scarcity. This leaves room for landlords to profit whilst treating students terribly. (Private landlord)

Homelessness among students

We asked those in the survey if they had ever experienced homelessness as a student, and 7% said yes.

This has been a challenging issue to gain a clear picture of due to the complexities of homelessness.

Not all students who answered "yes" to having experienced homelessness chose to give further information. However, among the reasons given, examples of hidden homelessness – especially sofa surfing – appeared particularly often.

Some mentioned needing to sofa surf as a temporary measure between tenancy contracts or while housing problems were repaired.

Others referred to familial relationship breakdowns, highlighting the challenges some students face to find accommodation outside of term time if it's not an option to live with parents.

Here are some examples of why students said they have experienced homelessness:

- Could not find a room to rent in London and I was couchsurfing while looking for places and decided in the end to move back in with parents until I graduate this June.

- I couldn't pay my rent on time so I had to evacuate the hall.

- Just lost the last place I was renting due to the landlord changing the [contract].

- I had nowhere to sleep for some days but I crashed [on] a friend's sofa.

- My parents threw me out and I had nowhere to go so I slept in a run down unoccupied house until I could move in to student accommodation.

- I had to go back to uni early for work and was unable to extend my accommodation contract by two weeks.

- I had to sofa surf for one month after a water pipe burst in the accommodation kitchen. The uni had no spare available rooms to house the five of us.

- Had to move out of halls because of noise and mould, slept on my friend's couch while I found a new flat.

- I was [living] in a YMCA and I was later evicted because I was unable to pay rent whilst at uni. I had just [become] estranged from family and was not eligible for Student Finance.

- Sofa surfing and living in a hotel due to negligency from my council.

How much does student accommodation cost?

Among those in the survey who pay rent, the average cost is £550 per month.

Compared to last year, this has increased by 2.8%, up from £535. Interestingly, this does match the percentage increase in Maintenance Loans in England for the 2023/24 academic year – but we don't necessarily see this as something to celebrate.

The situation hasn't improved. Rather, we are still hearing from a very similar proportion of surveyed students who say rent is a struggle.

20% of those in the survey who pay rent described it as a constant struggle to keep up with the cost, while 44% said they struggled from time to time. Combined, this means that almost two-thirds are struggling with rent at least some of the time.

In comparison, last year 18% had described it as a constant struggle and 45% said they struggled from time to time.

When we break down the average rents in the survey by accommodation types, we see that those living in private halls are paying the most (£613 per month), followed by university accommodation (£596 per month). This is not surprising, though, as halls are generally more likely to have bills included in rent.

Surveyed students with private landlords are paying comparatively less (£525 per month).

What do students get for their money?

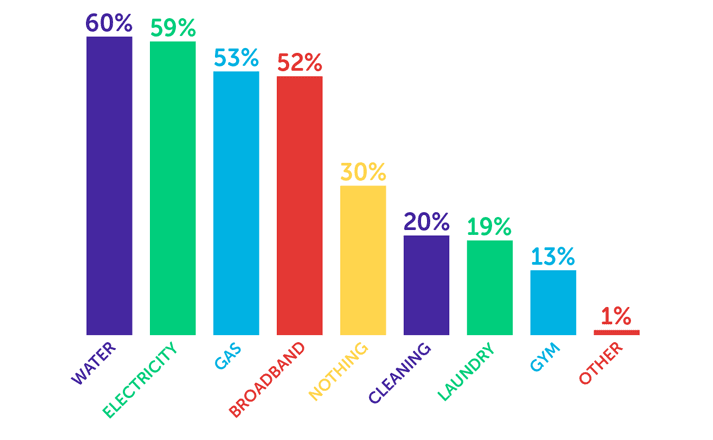

We asked students what, if anything, was included in their rent. Here's what they said:

While 30% said their rent didn't cover any extras, the majority had at least some form of bill or facility included. The most common answer was water (60%), closely followed by electricity (59%).

Here are some of the comments we received from students in the survey about the cost of rent:

- London is a very expensive place to live especially when my loan doesn't cover my rent so I need to make it on my own. (University halls)

- It's just really hard. No one seems to help. My rent is expensive as that was the only place available at the time for me, the cheapest places were sold out. (Private landlord)

- Really worry about money. My parents are topping up my rent when I can't afford it, but they are really struggling with the cost of living themselves. I have a part-time job and sometimes [work] full-time to pay for rent and living costs. (Private landlord)

- I'm a student originally from Wales so my Maintenance Loan/grant covers my rent and bills. (Private landlord)

- It is expensive and it worries me that I don't have much money left over to afford food. (Private halls)

- It's a constant battle of should I pay my rent or can I do a food shop? (Private landlord)

- My parents pay my rent for me but if they didn't I wouldn't be able to afford to stay enrolled. (Private landlord)

- I think student accommodation is completely overpriced from student halls to actual housing designed for students. It is an absurd amount of money for a room and these landlords are making so much profit. [...] My parents were shocked at the price and luckily I can just about afford it. I know some people however who are next year paying £225 for a room in a house per week excluding bills. (University halls)

- If I could not live here, I would have no reasonable affordable options of places to live within an hour of my university. (Private landlord)

- The rent is high enough that it makes it quite tight to afford much else. (Private landlord)

- Many of my friends live in housing they cannot afford with Student Loans and a job, it's ridiculous. (With parents/guardians)

- As a mature student (52yrs) I find it very difficult to find affordable housing from private landlords. (University halls)

- [Students] should have their accommodation paid for as part of their loan so there are no barriers to education. I have friends who work to afford uni but end up working more than coming to class… students are at the end of their rope, something has to be done, someone needs to advocate for us because the unis don't care. They just want to make money. (University halls)

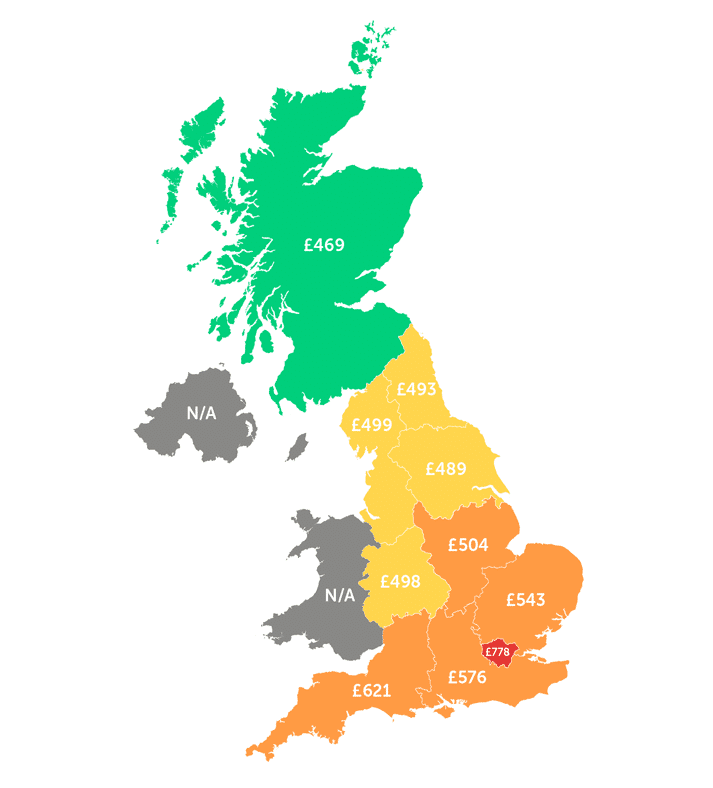

Student rent in each region of the UK

We looked into how student rent differs among surveyed students in different parts of the UK.

Unfortunately, we didn't receive enough responses in Wales or Northern Ireland to provide reliable figures for the average rent in either region.

But, as we see each year, London has the highest average rent (£778 per month).

Interestingly, all regions in the South of England have average student rents of over £500 per month, while all regions in the North of England have averages below £500 per month.

The West and East Midlands have very similar averages, both hovering around £500 per month.

Scotland, in comparison, has a cheaper average of £469 per month.

Student rental deposits

Among students in the survey, their average rental deposit was £263.

However, among those who have had a deposit, about one in six have struggled to get it back. This is relatively consistent with last year when 18% said the same.

These are some examples of why students have had issues getting their deposit back:

- They claimed things were missing that weren't there when we moved in.

- They said we didn't clean the oven to a high enough standard like how it was at the start of the year (even though it was brand new then).

- I was the last to move out and they charged me for all repairs instead of equally between us, £40 for redecorating the kitchen and £10 removing waste that was left by a person who moved in before I left.

- The landlord tried to charge us for many problems which the house came with (e.g. sofa stains), but this was eventually returned to us after showing pictures of it when we moved in.

- Claims of damage beyond general wear and tear however we had proof of damage before moving in. Despite this it still took four months after leaving the house to regain the money.

- They claimed the property wasn't clean despite a deep clean prior to leaving the house.

- It was never clarified and I lost £50.

- My flatmate's destruction of the kitchen.

- My flat was purchased by a new landlord and he needed the deposit from the old estate agents. I had to keep going back and forth between the two, being told that I need to get it sent to my bank by one while the other said they need to send it straight to the new landlord. This went on for about two weeks, with the old estate agents just ignoring and not handing over the deposit, causing me lots of stress during term time.

Students considering dropping out of university

Given the renting struggles many students experience, one major concern is the impact this can have on their abilities to stay in university.

While only a very small proportion of surveyed students said they have dropped out due to the cost of rent (3%), two in five have considered it. This is relatively consistent with last year when 38% had said they'd thought about dropping out due to rent.

| Have students considered dropping out? | Rent | Bills |

|---|---|---|

| Yes – thought about it | 40% | 28% |

| Yes – have dropped out | 3% | 2% |

| No | 57% | 70% |

Here are some comments from students about the challenges of staying in university when struggling with accommodation costs:

- When I couldn't find a place to rent I contemplated about dropping out or finishing my degree at a university with affordable accommodation. (With parents/guardians)

- Rent in Manchester keeps going up and I considered dropping out and moving to a university in the North of England closer to home as I don't think I will be able to afford it in 3rd year. My next year's rent already takes all of my Student Loan and I get the maximum amount. (Private halls)

- All this debt doesn't seem worth it sometimes. (University halls)

- I was thinking of dropping out and instead just trying to find a job as I was losing so much money and finding it hard to eat and pay for rent. (University halls)

- Sometimes the stresses of finances demotivates me and I do consider whether I should drop out. (Private halls)

- I am in the final year of my medical degree and would not drop out now. However, I have had significant financial difficulties this year due to the high rent and bills. (Private landlord)

- We are supposed to be looking for housing next year and the prices per week are that bad it generally makes me worry I will have to drop out for not having a place to live. (University halls)

- Debating whether or not the money I have to consistently raise, through a job or lending off parents, to secure a place during my studies is worth it. (University halls)

- I've thought about dropping out due to extortionate accommodation costs, for a small room as I have two part-time jobs just to try and pay some of the rent. My uni asks [me] to pay per term which is a lot to pay in one go, and the cost is a massive burden on me constantly. (University halls)

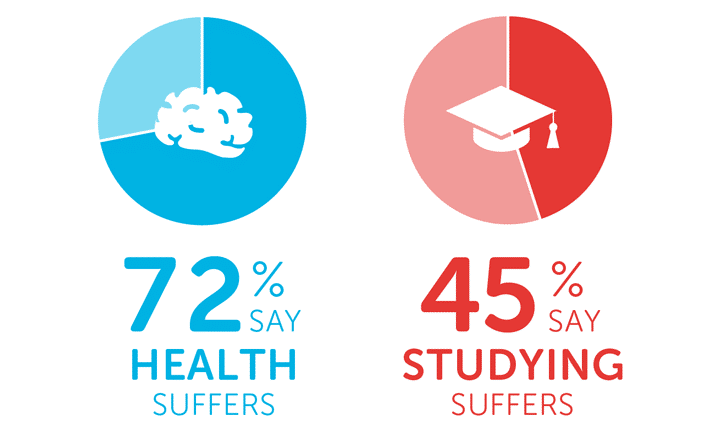

How rental costs impact students' health and studies

Overall, 72% of surveyed students said their health suffers as a result of rental costs – 53% said it somewhat suffers, while a further 19% said it greatly does.

We can break this figure down for both physical and mental health:

- Mental health – 52% said it somewhat suffers and 18% said it greatly suffers.

- Physical health – 36% said it somewhat suffers and 11% said it greatly suffers.

As well as this, among those who have had problems with their accommodation, 45% said their studies suffered.

Here are some comments from students in the survey about how renting affects their health and studies:

- With the cost of food etc. it's getting too much. I work two part-time jobs just to afford it which affects my grades. (University halls)

- I just feel like all my time goes towards affording rent, so much that my studies suffer because of it. This often makes me question what I'm even doing all of it for. (Private landlord)

- It's a struggle to work full time just to be able to afford accommodation, food, and bills. It makes me suffer as a student and it's hard to continue on. (Private landlord)

- The stress on top of my busy high workload (taking law) is getting to the point where I struggle to concentrate and focus on all key elements of my work. Therefore it's having a reflection on my academic performance. (Private halls)

- The electric bills are just too high that it gets to 11° inside the house but we can't put the heating on because of how expensive it is and it just makes you ill, let alone uncomfortable. (Private landlord)

Student energy bills

When discussing energy bills, one thing to consider is that many students have bills included in rent – especially those living in halls. In fact, 56% of students in this survey said they have energy bills included.

Among those who pay energy bills separately to rent, they are paying an average of £86 per month.

Interestingly, this is £1 higher than in the 2023 survey, but students are generally showing more confidence in keeping up with bills.

Last year, 22% of those who paid bills described it as a constant struggle to keep up with them, while a further 42% said they struggle from time to time.

This year, it has dropped to 19% describing it as a constant struggle and 36% saying they struggle from time to time.

On top of this, among students who pay bills and rent separately, we can see further changes in their behaviours around energy usage that again suggest a slight change in confidence.

| Ways to use less energy | How many students did this in 2023?* | How many students did this in 2024? | Difference (percentage points) |

|---|---|---|---|

| Not put the heating on | 71% | 73% | + 2 |

| Stayed in bed longer than usual to stay warm | 64% | 62% | - 2 |

| Had shorter/fewer showers | 49% | 46% | - 3 |

| Asked housemates to use less electricity/gas | 51% | 46% | - 5 |

| Spent longer at uni to avoid using electricity/gas at home | 48% | 40% | - 8 |

| Not cooked as often | 33% | 33% | 0 |

| Used an electric blanket | 20% | 19% | - 1 |

| Asked landlord to improve insulation | 15% | 16% | + 1 |

* The 2023 figures in this table are different to those in the 2023 report. This is because these just apply to answers given by students who pay rent and bills separately, whereas last year we had included responses from all surveyed students. By only looking at responses from those who pay energy bills, we can get a closer comparison of how behaviours have changed.

Two categories saw a slight increase: not putting the heating on (+2 percentage points) and asking the landlord to improve insulation (+1 percentage point). Meanwhile, the same proportion said they were cooking less to save energy in both 2023 and 2024.

However, in all other categories, there was a smaller proportion than last year saying they needed to reduce their energy usage that way, suggesting a slight overall improvement.

How students pay for their rent

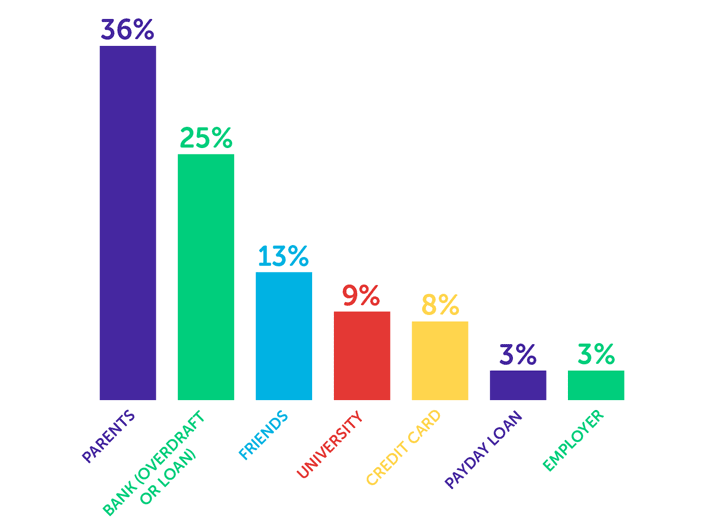

With many finding their Maintenance Loan falls short of covering their living costs, three in five told us they borrowed money to cover rent.

So, where do students turn when they need extra money?

We asked students if they borrowed money from any of the following sources to cover rent: their parents, bank, friends, university, credit cards, payday loans or employer.

With over a third saying they would go to their parents, this was by far the most common answer.

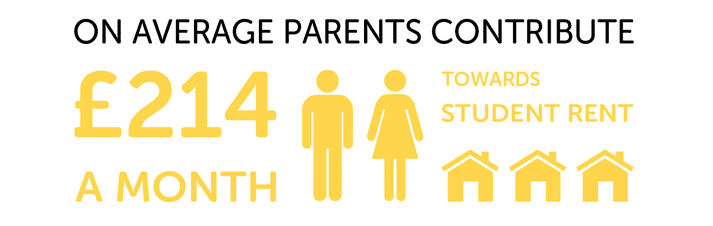

How much do parents pay?

Compared to last year, we have seen a sharp increase in the amount of money surveyed students receive from parents to help with rent.

Among those who pay rent, they receive an average of £214 per month from their parents to cover the cost.

In the 2023 survey, students had been receiving £145 per month. That had been noticeably lower than in 2022 and 2021 – the average for both years had been £191 per month.

Last year, we studied the findings in the context of the cost of living crisis, understanding that the rocketing inflation rates were impacting parents as well as students. That could potentially have led to parents generally struggling to give their children as much money for rent.

This year, however, the economic climate has changed. CPI inflation (which tracks the changing cost of goods) was 4% in December 2023. This is double the 2% target that the Bank of England aims for, so still higher than we would hope to see, but significantly lower than the December 2022 rate of 10.5%.

At the same time, figures from the ONS indicate that regular earnings have started to increase faster than prices. As such, for many working parents, it could have been slightly easier to financially support students at university in the 2023/24 autumn term than it had been in 2022/23.

Here's what students in the survey said about borrowing money from their parents:

- My Maintenance Loan doesn't even cover rent so I rely on my parents to loan me money, which I am beyond grateful for. I wouldn't be able to afford accommodation without their support. Many [students] don't have this option. (Private halls)

- It's challenging to afford the necessities at uni as my family can't financially support me. (University halls)

- If I didn't have my parents to help with bills there's no way I could afford to be a student in Manchester. Loans just aren't enough and with my degree it's so hard to find a part-time job as well as keeping sane yourself! (Private landlord)

- Despite not having the full Maintenance Loan I get some busary from the university. A lot of my parents' income goes towards my dad's health as he is ill so the government expecting them to 'top up' doesn't help. (Private landlord)

- It's a great cost on my family, I feel so guilty [they're] having to support me so much where the government funding fails. (Private landlord)

- Basically my entire Maintenance Loan goes towards rent, meaning my parents who are struggling themselves have to send me money just so I can eat. (Private landlord)

What issues do student renters face?

As a minimum, rental homes should be safe, secure and hygienic. But, too often, this isn't the case for students.

We asked students about the challenges they have experienced with accommodation, both related to their housemates and the conditions of their housing.

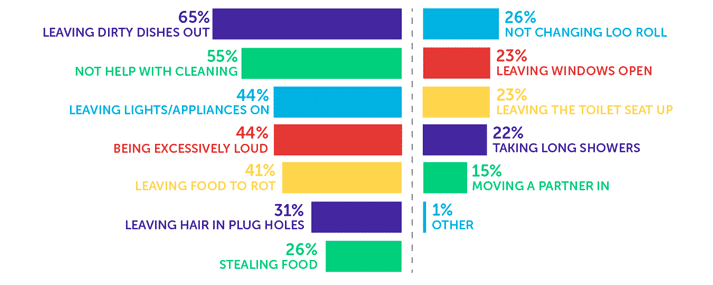

Biggest problems with housemates

Here are the problems students in the survey have had with their housemates:

The most common housemate problem is leaving dirty dishes out (65%). This, combined with the second most common issue of housemates not helping with cleaning (55%), can lead to unpleasant and unhygienic living conditions, as highlighted by one student:

I went home for the summer and my flatmates did not – when I came back (after ~five months) nothing had been cleaned. There were huge piles of dirty dishes (some of which were mine and had been used without asking), half of the food in the fridge was rotting (there were multiple open cartons of milk that had completely solidified), the bins were overflowing, the shower was blocked, there were five different colours of mould growing in the bathroom, some garlic had been dropped on the stairs and left to rot, none of the floors had been mopped/hoovered, and there were piles of stuff (both rubbish and just belongings) in every corner. (Private landlord)

Biggest problems with properties

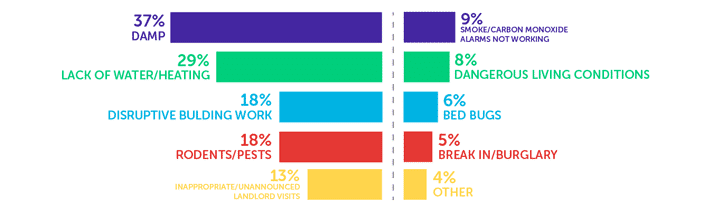

In terms of the properties students live in, these are the issues those in the survey said they've had:

Similarly to last year, damp is the most common housing issue for surveyed students, affecting over a third (37%). This is followed by a lack of water/heating (29%) and disruptive building work (18%).

Here are some examples of housing issues students highlighted:

- The whole accommodation is a building site, which is unclean and unhygienic. (University halls)

- The house we pay so much for has damp walls and gaps under doors and no insulation meaning in order to live healthy we would need to pay even more for heating than we could afford. My room is so damp I can't stay in it. (Private landlord)

- Kitchen flooded with hot water. Window couldn't be opened due to the lock, so it was extremely hot. When we called security they came and laughed saying how you could make a brew with this. (Private landlord)

- Our house is constantly coming up with new problems – mould, flooding, breakages etc. (Private landlord)

- Slugs kept getting into our kitchen and we have had a lot of issues with mould and damp. (Private landlord)

- It is very damp with mould patches on the walls and is always freezing despite having the heating on. (Private landlord)

- I have to clean the mould off the window at least weekly because otherwise it builds up and spreads to the walls. The floor near the front door is broken and the door has no seal so it's very drafty and damp. The house hadn't been cleaned when we moved in, we found other people's rubbish and items in our rooms. (Private landlord)

- One room was so mouldy and the carpet was damp to the touch. A mould expert said there's no ventilation in the house aside from the windows but the landlord will not change this at all. We had to fight with him to change the carpets at least. (Private landlord)

- Once my room flooded with an inch of water and it took my accomodation two days to fix the pipe that caused the flooding. (Private halls)

How long does it take to get problems sorted?

While 17% said that their housing issues are resolved in a day, and almost half (48%) said they're resolved within a week, this leaves over a third (35%) who find it takes more than a week for things to get fixed.

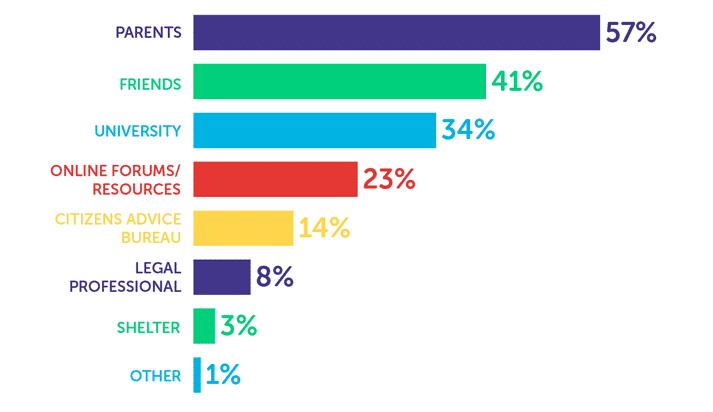

And, when students do face issues with accommodation, this is where they turn for help:

By far the most common source of help is parents, which nearly three in five surveyed students said they would ask if facing accommodation issues.

Is student housing worth the spend?

As we have covered, many students struggle to afford their rent. So do they view their accommodation as good value for money?

Unfortunately, 45% say their accommodation is not good value for money. This is slightly worse than last year when 41% had said the same.

Here's what some students said about the value for money of their accommodation:

- I don't hate it, but I don't think that it's good value for money AT ALL. The staff are incredibly hostile, the rooms are absolutely tiny, the kitchen space is very limited and there is no sofa/lounge area. When we want to socialise with one another, we have to squeeze onto one of the five broken chairs around the kitchen table, illuminated with fluorescent lighting that we can't switch off. (University halls)

- I would consider my accommodation this year good value for money. It is a good size for two people and it is very close to our campus. Our only issues [are] the lack of space/storage in the kitchen and the poor insulation. (Private landlord)

- It's very expensive but good value for money given I would need to live much [farther] away if paying the same price for non uni accommodation. (University halls)

- It's not too expensive but it's definitely not worth what I'm paying (especially given how much it's gone up in the past couple [of] years). The rooms aren't very well-insulated, I have a constant draft coming through. (University halls)

Students' house buying prospects

With the uncertainty surrounding the house-buying market, we wanted to find out more about when – if ever – students expect to buy a house.

The median age given by students was 30.

But 14% don't expect to ever buy a house.

On top of this, 7% said they don't expect to buy a house until 40 or older.

Some reasons students gave for not feeling confident about buying a house included high property prices and the challenge of saving up for a deposit after graduating with debt.

Here are some students' views on their likelihood of getting on the property ladder:

- Honestly I think 35 is optimistic.

- I'm worried I'll never have enough money to buy a house as the deposit amount will keep going up before I will have enough.

- I've been lucky enough to have been saving a long time for a house – opening a LISA was great and I'm overall quite responsible with my money. However, I acknowledge that it is absolutely ridiculous to get on the property ladder before your 30s these days. My biggest struggle right now is my credit score.

- I hope to own my own house by 35 but [I] doubt it will happen due to the amount of debt I will be in once I leave uni and that I am currently in now.

- Don't know when I'll have the money to buy a house, but hopefully soon after graduating and finding a well-paying job.

- I don't see how anyone can afford to buy a house – maybe rent flats but buying a house sounds crazy at current.

- My course is quite long and I will be 25 when I graduate. There is little guarantee for getting a job after graduation and I'll have to do a master's to get a job in research, so it will be a while before I can even afford a deposit on a house.

- I have no hope that I'll be able to buy a house. My mum has always rented because of low income and housing prices will obviously only go up as time goes on.

- I can't save any money up as it all goes towards being able to live at uni so it'll take forever to get a job to save money to buy a house.

- I'm hoping to buy a house ASAP, but I have no idea when I'll be able to – I know that I have a better chance as I'll be a nurse.

What others say about the survey

Kellie McAlonan, Chair of the National Association of Student Money Advisers, said:

What we are seeing in the survey results should not be surprising. It's been evident for some time that students can often get the short end of the stick when it comes to having safe and affordable housing and many are reconsidering their studies, or finding that their health or studies are impacted as a result of worrying about accommodation.

The National Student Accommodation Survey gives us the data needed to allow colleges and universities from across the country to better understand the challenges students are facing. But what we really need is for the government to better understand this, and to address these concerns in a meaningful way.

Struggling to pay rent is a reality for many students, and it isn't good enough. Core funding packages need to be good enough to support student success, and safe and affordable housing shouldn't be a lucky find.

The Maintenance Loan in England needs a revamp. Students can't be expected to plug the gap between basic living costs and the student funding they receive, and it is becoming increasingly more difficult for institutions to shoulder the burden of a system that is not working.

Student housing resources

These guides include info or advice about many of the topics covered in this report:

- National Student Money Survey

- Student rent calculator

- How to get help with energy bills

- Cost of living crisis: 20 ways to cope

- Parental contributions calculator

- How to save money on rent.

About the National Student Accommodation Survey 2024

If you'd like to know more about the survey or receive expert comments, please get in touch.

You're welcome to reference or re-use data from the survey with credit and a link back to the site: "Source: The National Student Accommodation Survey 2024 / www.savethestudent.org".

Stats were calculated based on 1,007 responses from undergraduate students.

The survey was open for responses from 17th November 2023 – 12th January 2024.

source https://www.savethestudent.org/money/surveys/national-student-accommodation-survey-2024.html