Each year, banks compete for students' custom with cash offers, 0% overdrafts and more. But, as we approach the end of 2023/24, how do students feel about their banks – and will they switch?

Credit: fratello – Shutterstock

In the tenth annual Student Banking Survey, students revealed what they look for in a bank and what (if anything) would lead them to switch accounts.

Although many were happy with their account, over one in 10 of those surveyed said they wouldn't recommend their bank to a friend.

And buy now, pay later (BNPL) services received very mixed reviews. Comments ranged from describing BNPL as "super helpful" to "a poverty trap".

We explore all this and more below.

What's in this report?

- Key findings

- How do students choose a bank?

- What is the most popular bank among students?

- Student satisfaction with their banks

- Do students consider switching banks?

- Student borrowing habits

- How many students use BNPL services?

- How many students have Lifetime ISAs (LISAs)?

- How often do students use cash?

Key findings from the Student Banking Survey 2024

Here's an overview of the key findings from this year's Student Banking Survey:

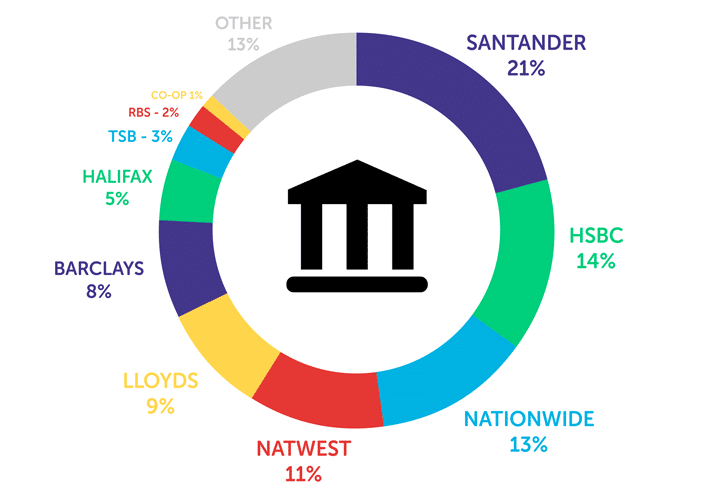

- Santander remained the most commonly-used bank among surveyed students (up from 20% in the 2023 survey to 21% in 2024).

- Natwest and RBS have overtaken Santander for student ratings in 2024, with the banks receiving average scores of 4.28, 4.17 and 4.14 out of 5 respectively.

- 14% of surveyed students are looking to switch banks.

- Among those with overdrafts, 29% have reached their limit at some point.

- 31% use BNPL services at least some of the time. This includes 5% who use them often.

- 26% have a Lifetime ISA (LISA) account, but 20% don't know what they are.

How do students choose a bank?

When picking a bank, surveyed students were influenced by these factors:

In the survey, nearly half (47%) selected an account based on where they already banked. This has consistently been the most common answer for how students have chosen their uni bank account since we launched the Student Banking Survey in 2015.

As the second most common reason was that their friends or family banked there, it's clear that having a familiarity with the bank plays a big part in students' decisions.

Additionally, 25% said they decided based on freebies or discounts. Some banks offered £100 cash plus other benefits to encourage sign-ups ahead of the 2023/24 academic year, so it's interesting only a quarter were swayed by these perks.

Where do students do bank account research?

Around two-thirds of students in the survey turned to money-advice websites to research bank accounts. Alongside this, around three in seven asked their parents.

In comparison, the proportions of those searching for information on social media (TikTok, Reddit, Youtube, Instagram and/or Facebook) were significantly lower.

Here's a closer look at where surveyed students research bank accounts, broken down by their university years:

| Where students research banks | 1st years | 2nd years | 3rd years | 4th+ years |

|---|---|---|---|---|

| Money-advice websites | 59% | 72% | 62% | 81% |

| Parents | 46% | 42% | 39% | 45% |

| The bank | 32% | 26% | 20% | 15% |

| Friends | 22% | 34% | 34% | 25% |

| University/SU | 8% | 14% | 10% | 6% |

| School | 5% | 6% | 5% | 4% |

| 4% | 7% | 11% | 6% | |

| TikTok | 4% | 11% | 7% | 9% |

| 3% | 7% | 9% | 2% | |

| 3% | 2% | 4% | 2% |

Second and third years were generally more likely than first years to use social media for research – and less likely to rely on the bank or their parents for guidance.

This could suggest that, as students become more comfortable with banking, familiarity with the bank carries less weight and they choose to do more independent research online.

These are some of the comments students made about choosing a bank account:

- It's a minefield if you don't know what you're doing, but there are plenty of perks if you look in the right places. Should be taught in school!

- More advertisement/promotion of ethical student accounts WITH PERKS still would be amazing. As an 18 year old, I didn't realise how banks invested money into weapons, fossil fuels, and other unethical industries, so if I'd seen information about this and an alternative that was still attractive, that would have been brilliant.

- Incentives are good.

- [I] don't notice much of a difference to normal current accounts save for the joining incentives.

- Incentives have gotten less enticing/valuable in [the] last few years. 0% overdraft [is] very useful as a working student.

- Banks should make it easy [to open an] account totally online for students.

- Not accessible to international students that moved to the UK for university.

- The incentives and options for overdrafts are very appealing.

What is the most popular bank among students?

With over one in five surveyed students banking with Santander, this was the most common choice.

In the above bar chart, we focused on banks that offer accounts designed specifically for students. However, 13% answered that they have accounts with other banks. These were:

- Monzo (5%)

- Virgin Money (2%)

- Revolut (2%)

- First Direct (1%)

- Metro (1%)

- Starling (1%)

- Chase (1%).

Student satisfaction scores

NatWest and RBS have overtaken Santander for student ratings.

In the 2023, 2022 and 2021 surveys, Santander received the highest ratings among banks with student accounts. However, in 2024, they received 4.14 – falling below NatWest (4.28) and RBS (4.17).

Do students consider switching banks?

Despite the range of offers available for switching banks, only 14% of those in the survey said they were looking to change accounts.

Students gave mixed reasons both for and against switching. Some wanted to take advantage of perks and bonuses elsewhere or find more ethical banks. Others, meanwhile, wanted to stick with their bank out of loyalty, convenience or to protect their credit score.

These were some of the reasons why students considered switching bank accounts:

- I think the freebies included in most student banks are a great incentive for swapping – I did so.

- Better offers and perks and interest rates elsewhere.

- [I] currently have two bank accounts and would like to move my money into one, ideally a more ethical/environmentally sustainable provider (e.g. Nationwide).

- For the switching bonus.

- Because Monzo is a virtual bank I'd like to keep my cash in the physical bank.

- [I] want a more ethical one.

- For better interest rates.

- So I don't need a card reader.

- I'll be graduating soon and will need a graduate current account with a good overdraft.

And these were some reasons why students decided to stick with their current banks:

- Pain to change an existing account to a student account.

- Very happy with my current account!

- If it isn't broken, don't try and fix it! My bank already provides me with all I need and comparing to other banks, their benefits don't outweigh 1) leaving Lloyds and my loyalty to them and 2) going through the effort of setting up another bank account when it's completely unnecessary.

- I have all that I need with NatWest.

- No other bank has a better app.

- I am quite satisfied at my current bank. Also, switching banks would affect my credit score which I am currently trying to improve.

- I can't switch because I have a savings account only for account holders.

- I am happy with TSB and their rewards system.

Student borrowing habits

In the survey, we asked students about their views and experiences related to borrowing money, specifically: overdrafts, credit cards and BNPL.

How overdrawn are students?

| Size of overdraft | Students overdrawn by this amount |

|---|---|

| Not overdrawn | 76% |

| £99 or less | 4% |

| £100 – £499 | 6% |

| £500 – £999 | 3% |

| £1,000 – £1,999 | 7% |

| £2,000 and over | 1% |

| Rather not say | 3% |

Over three-quarters of surveyed students (76%) said they weren't overdrawn, and a further 3% chose not to say.

Among the 21% who told us they were in their overdraft, nearly two in five said they were overdrawn by £1,000 or more.

Worryingly, of those with an overdraft, 29% have hit their limit at some point, while 39% don't know when it needs to be repaid.

While some viewed overdrafts as a benefit of student bank accounts, others highlighted the potential dangers of misusing them or misunderstanding the borrowing terms.

These are a few examples of what students said about overdrafts:

- I think that more students should be warned about going into their overdraft. Large overdrafts are a big selling point for student bank accounts, and obviously a lot of people rely on them for legitimate reasons, but the importance of the repercussions of using it should be emphasised.

- The overdraft has allowed me to be flexible with my money.

- It's easy to get stuck in an overdraft as it seems like free money.

- Students shouldn't have such a big overdraft limit.

- I got an overdraft that was very useful when Student Finance didn't give me the right amount of money last year.

Do students have credit card debt?

Just over one in 10 surveyed students told us they have credit card debt. This is significantly lower than in the 2023 survey when 26% had said the same.

Similarly, compared to last year, we've seen a drop in the proportions using buy now, pay later services.

How many students use BNPL services?

In 2023, 9% said they often used BNPL while 34% said they sometimes did. In 2024, this has dropped to 5% saying they often use it and 26% saying they sometimes do.

While some talked positively about the payment services, we also heard from students who distrusted them. Here are some responses we received when we asked what they thought of BNPL:

- I think that they're good for the average working person who knows that they will have that money hit their account at least every month but for people living off of a Student Loan and nothing else I feel like there is no need as the money is all received in one lump sum and people can often forget that they have set them up and then they could have spent all the money and not have enough to pay the following months.

- Dangerous.

- I think it's a good idea and it's something I would want to explore in the future, just haven't got around to it yet.

- I think it's a scam and a very horrible thing to be set up.

- It's [an] absolutely great service for everyone and it also helps us to get a good credit score.

- Really good if there's something you need and can't afford straight away or to split payments into instalments for larger items. Also, for example I was going to a wedding and ordered £300 worth of dresses but was unsure if I'd keep any so by buying now and paying later I was able to try them on without needing the money right now.

- I don't know how reliable they are.

- A poverty trap sometimes.

- It's useful as it's there for people who need it, but is also something that requires discipline. Many people may try to exploit this by consuming everything now (greed) and thinking they'll pay it back later when in reality they do this so often that they don't realise how big their bill (with interest especially) is later on. It gives a sense of money illusion, so once you cave into it, it is difficult to come out of it. Even though I know I'd be disciplined if I had to use it, I am still actively avoiding it as I believe it is never ok to be in debt or even be anywhere near it.

How many students have Lifetime ISAs (LISAs)?

With Lifetime ISAs (LISAs), you can save up to £4,000 per financial year, and receive 25% of the yearly savings as a bonus from the government.

The accounts have been heavily promoted in financial media over recent years as effective ways to save up for a house. It's therefore unsurprising, but promising nonetheless, that we've gradually seen a growing awareness of them among students.

In the 2021 survey, 35% said they didn't know what LISAs were, which dropped to 32% in 2022 and 25% in 2023 before decreasing further to 20% this year.

While 54% of students in this survey were familiar with LISAs but chose not to have one, 26% said they did have an account.

How often do students use cash?

Back in 2021, when the coronavirus pandemic led many to move away from cash payments and go contactless for hygiene reasons, 12% of surveyed students told us they never used cash.

However, each year since then, we've seen this gradually change. In 2022, 10% said they never used cash. This decreased to 9% in 2021 and has dropped further to 8% this year.

Here's an overview of how often respondents in 2024 use cash:

| Frequency of cash use | Students using cash this often |

|---|---|

| More than once a day | 4% |

| Once a day | 2% |

| A few times a week | 7% |

| Once a week | 8% |

| A few times a month | 26% |

| Once a month | 12% |

| Less than once a month | 33% |

| Never | 8% |

Although the proportion that never use cash has decreased, 41% use cash less than once a month or never. As such, for two in five students in the survey, cash payments are a rarity.

About the Student Banking Survey 2024

- Source: Student Banking Survey 2024 / www.savethestudent.org.

- The survey received 760 responses.

- Students were polled between 4th April – 21st May 2024.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

source https://www.savethestudent.org/money/surveys/student-banking-survey-2024.html